Complete Guide to Bookkeeping For Hair Stylists

For your business to succeed, you have to practice proper bookkeeping for hair stylists. You’ll accumulate a lot of financial transactions in your salon POS system that need to be properly recorded so that you can track your progress and make sound decisions. Bookkeeping refers to the recording of all financial transactions that take place in a business.

With several bookkeeping methods available, how do you know which one will be most suitable for your business? Here is a guide to help you know the best practices that will put your business at a higher notch.

The article discusses the importance of bookkeeping for hair stylist and how to use it to make operations better and improve financial transparency. It also highlights apps hair stylists can use.

Bookkeeping ensures there is proper financial health in a salon. Unfortunately, some business owners ignore it and end up suffering from financial turmoil. Here are some of the reasons why self employed hairdresser bookkeeping is essential.

Every successful business usually has a budget that directs the person in charge of accounts on the next step to take. When you know the business’ expenses and income, you can make key decisions that won't hurt your finances.

As a business owner, you are probably aware that some parties may be interested in knowing your financial conditions. These include lenders, investors and maybe customers. If you don't provide these details, it could cost you the relationship you have formed with them. Having well organized financial records helps you present the figures to interested parties when the need arises.

The taxman expects you to file returns at the end of every tax year. You don't need to start looking for financial records a few days before the deadline. Maintaining organized bookkeeping ensures you’re always ready with the required information.

Bookkeeping helps you analyze the performance of your business. It lets you understand what is working and what is not so that you can take the necessary steps.

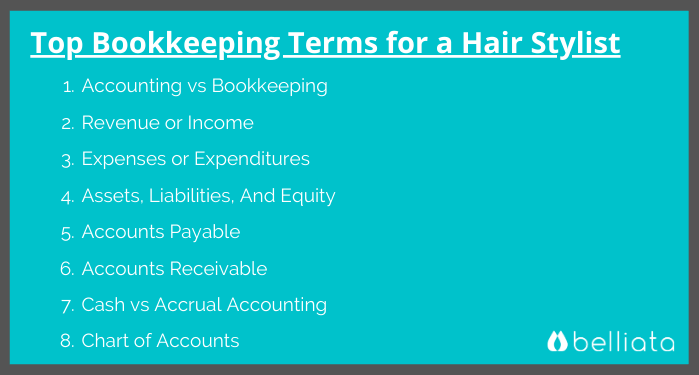

Accounting refers to analyzing the business financial records to make critical business decisions, while bookkeeping refers to recording every transaction in a small business or rental booth.

Revenue or income refers to the money collected after selling products or offering services.

Expenses or expenditures refer to the total amount of money a business has spent running its operations e.g. rent, utility bills among others.

Assets refer to the valuables that the business owns. Liabilities refer to the debts a business has, while equity is what is left after subtracting liabilities from assets.

Accounts payable is the account where all payments a business owes to vendors, contractors, or any other party are recorded.

Accounts receivable is the ledger where all the records of what customers owe a business after purchasing goods or services are recorded.

With the cash method, transactions are recorded after payments have been received after selling goods or services. In accrual salon accounting, transactions are recorded every time a purchase is made, whether payments have been made or you have sold products on credit.

Chart of accounts is a simple list containing categories an organization uses to classify financial transactions like credit, expense and income.

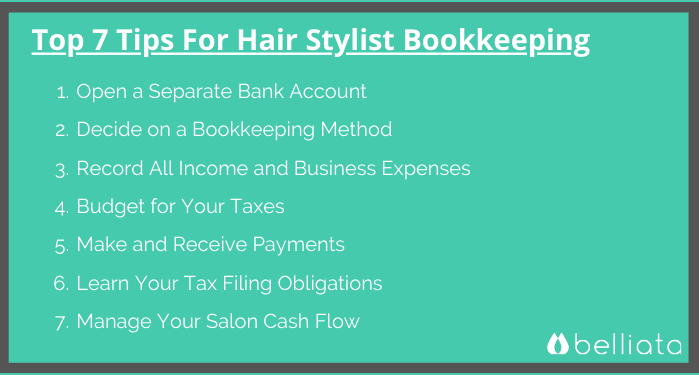

Opening a separate bank account from your personal account keeps things transparent and straightforward. This ensures that you don't spend money meant for business purposes for personal uses. Opening two separate accounts means that you’ll be paying yourself some of the money you get from your small business and be able to plan your business finances.

You definitely need a suitable bookkeeping method to record all your revenue and expenses. There are two methods you can choose from. These are the cash or accrual method. If you choose the cash method, you’ll be recording revenue or expenses after cash payments are made. The accrual method involves recording all transactions, whether the payments are made or not. While the cash method is simple and much easier, the accrual method provides more financial transparency.

If you choose the cash accounting method, a single entry method will be appropriate. In this ledger, only one account is affected by a transaction and is very simple to use. With the accrual accounting method, the double-entry method will be appropriate since every transaction will affect two accounts.

Expenses refer to the amount spent on running the business. On the other hand, income is the amount of money received after selling goods or services. It’s crucial to record all income and business expenses to keep track of your progress. You also need to make sure there is no form of fraud taking place.

Another thing you should be careful about is keeping all receipts. If you bought an item for your business or rental booth and want to return it to the seller for various reasons, the seller will require you to represent a receipt to prove that you purchased the item.

As a hair stylist, you’ve an obligation to pay taxes.

Unfortunately, some salon owners fail to save enough money to pay taxes and start looking for the money from other sources as the tax returns deadline approaches.

It shouldn't be that way.

Always have a plan and save some money from your income to make sure you pay taxes on time without borrowing funds elsewhere.

You need to pay your suppliers and employees. You also need to receive credit card payments from customers. You can choose to pay your employees hourly, monthly, or commission.

Think about all the methods available and choose the simple and suitable ones. Come up with a payment policy and communicate it with your clients. Have several payment methods such as debit cards, money transfers, and cash payments to offer every customer convenience.

You also need to pay your suppliers on time to maintain a good working relationship.

Learning your tax filing obligations helps you avoid penalties that may arise. It also helps you in tax budgeting. This information is usually found on government sites and is easily accessible.

Managing a hair salon's cash flow ensures that you always have enough money to run your salon and that cash in is more than cash out. To manage the cash flow properly, salon owners can keep track of all expenses and income using a hair stylist income tracker.

Incorporating a spreadsheet into your daily tasks comes with several benefits. These include:

Spreadsheets are very useful in tracking the income you have received from your salon. You can split the income you have received within a specific duration, such as a year and sources, which gives you insights about your small business.

With spreadsheets, salon owners can store data in an organized manner that’s easy to retrieve. They offer tools that not only make your work organized but appealing as well.

You’re probably wondering whether you need to hire a bookkeeper or not. Many stylists decide to do bookkeeping on their own, thinking they are saving money, which might not be the case. Having a bookkeeper helps you focus on providing services to clients while they take care of financial records. They also come in handy when you don't have any accounting background.

Additionally, having someone else help you in your small business enables you to achieve a work-life balance since you don't have to deal with several things with less time. Unless you’re an expert and you’ve enough time to handle both finances and attending to your clients, hire a bookkeeper.

Nowadays, many beauty shops and hair stylists have turned from manual accounting books to digital tools, due to the many benefits they reap. One of the best digital tools you can invest in is a bookkeeping app. Here are some of its benefits.

With a bookkeeping app, your financial transactions are safe. No one will tamper with them since you can limit people from accessing the app.

You choose who to give your passwords to. In case a financial problem arises, you can retrieve your documents from the system for backup.

You should never ignore the importance of saving receipts. With a bookkeeping app, you can easily save your receipts for future use. Unlike manual storage, your receipts will remain safe for long periods, and it takes less time to retrieve them.

A lot of things happen in a small business every day, and information can get quickly piled up.

With a bookkeeping app, retrieving information is easy.

Unlike when using books, you can access the information from different devices like computers, tablets, or smartphones, from any location.

Xero bookkeeping app gives you access to your financial details, no matter which location you are in. It enables you to manage invoices by checking your payment history. The app allows users to create invoices and send them via the channel of their choice.

The accounting software also helps in monitoring your spending and gives insight on bank account balances, cash flow, outstanding invoices, profit and loss statement for self employed hairdresser and bills you should pay using a credit card or any other payment method.

You can also use a free profit and loss template for self-employed hair stylists.

QuickBooks for hair stylists helps you track expenses, sales, and profits. Accessing the app is much easier using smartphones, tablets, or even PCs. The bookkeeping app also allows you to send invoices to clients, track inventory, generate sales quotes, among other features, with less time.

Expensify accounting software documents receipt and expenses. It also generates reports and keeps track of your spending. This app is ideal for both large and small businesses and allows different payment methods such as credit cards.

FreshBooks is a useful tool for tracking invoices. It also helps you make or receive payments through platforms like mastercard, visa, and other credit cards. The accounting software also makes tracking sales and expenses much easier and generates financial reports.

How much you spend on bookkeeping depends on the complexities of the daily transactions and the kind of bookkeeping apps you use. Every business is unique, and there are no set prices for bookkeeping services.

Bookkeeping for hair stylists is a crucial aspect for hair salons. Proper bookkeeping ensures financial transparency and organization, helping in better decision making, and meeting your tax obligations.

Unfortunately, it can be challenging for you to practice proper bookkeeping, especially if you don't have an accounting background. Luckily, you can use professional bookkeepers and accounting software to smoothen the process and have adequate time to attend to your clients and other aspects of your business.

And if you love these ideas or have some other ideas that you've used in the past to promote your salon business, why not share it with the Zolmi community in the comment section below. We would also be delighted to answer your questions, as well.

Ancient double-entry bookkeeping

https://books.google.com/books?hl=en&lr=&id

Double-entry bookkeeping and the birth of capitalism: Accounting for the commercial revolution in medieval northern Italy

https://www.sciencedirect.com/science/article/pii/S1045

Accounting for rationality: Double-entry bookkeeping and the rhetoric of economic rationality

https://www.journals.uchicago.edu/doi/abs/10.1086/229739