Complete Guide to Hair Salon Budget Plan for 2024

Whether you’re starting a new hair salon or trying to determine your salon’s monthly expenses for the coming year, having a hair salon budget plan is essential.

Having a financial plan prepared will help you keep control over your business and prevent unexpected problems from catching you by surprise.

We’ll take a look at the advantages of budgeting plans for hair salons, how to calculate your financial plan, as well as some suggestions and a salon budget sample template to help you get started.

It’s true that running a salon business means that sometimes you’ll have to deal with the unexpected, and you can’t prevent or predict every expense that might come up. What you can do is make sure that you understand your finances and your income and expenditures each month.

Then, you can make informed decisions about how to invest every dollar that comes through your doors, controlling your cash flow and spending only when it’s actually necessary to benefit your business.

This way, you’ll only spend the money that you actually want to spend, making each dollar work harder for you.

The best budgets are more than just a solid financial plan - they’re a breakdown of how you’ll spend, save or invest every dollar that you make this year helping you to get the most out of your money.

This is helpful because it lets you:

Forecast your monthly and annual earnings

Anticipate your expenditures

Plan any savings and financial investments for your salon business

Set aside controllable amounts for unexpected costs

Review your progress and make adjustments when needed

In an industry where clients, trends and the latest equipment are always changing, understanding your salon’s finances will give you peace of mind and control.

Even the best financial budget can still evolve and change as time passes or new data is introduced.

A salon’s owner should review the financial plan on at least a monthly basis, keeping track of the money going in and out and adjusting the model if they decide that it’s time to run things differently.

Budgets are dynamic and can change with every new analysis if need be. The point is to make a plan, understand how it will work, and stay on top of each expense.

So, how do salons manage finances effectively?

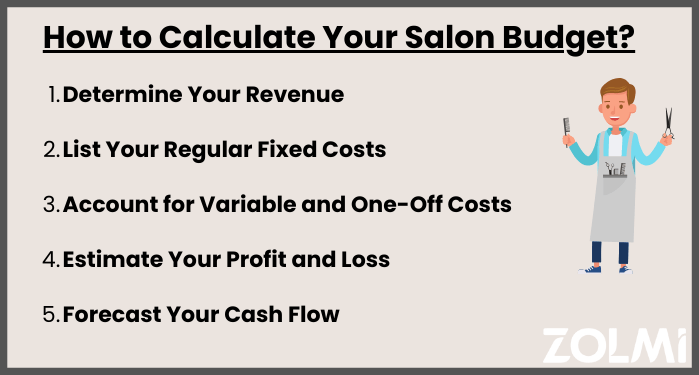

The best way to start is to figure out what your revenue and expenses will be each month, then use this model when creating a plan to handle both recurring costs and the variable salon expenses that you know will come up.

Finally, you’ll want to consider one-off payments that you might need to make, such as marketing expenses for seasonal events, purchasing equipment to replace damaged items, or paying for business startup costs.

All of this will help you to calculate your average profit and loss and predict your yearly revenue and profit margins.

Let’s take a closer look:

This is the full income amount that you bring in, both from retail sales and bookings. When calculating this number, don’t deduct your costs yet - we’ll do that later.

Established salons can calculate their revenue using data from last year’s financial records. For startups and first-time owners, you can base these cash flow numbers off of industry averages in your area - just make sure that you look at salons of a similar size and preferable in a similar location.

So, what are the expenses of owning a hair salon? To start with, let’s look at fixed costs.

Also called recurring costs, these don’t change from month to month or based on your income. To get this amount, add together all the payments you make that cover costs like rent, a loan or mortgage, taxes, equipment leasing fees, insurance, utility bills, staff salaries, internet and insurance.

Some months might see you paying a little more or less for things like utilities, depending on where you live. If that’s the case, feel free to add together the figures for a year and divide by twelve months.

Once again, if you’re just getting started and don’t have these financial amounts yet, check out the website for your municipal utilities service to get approximate prices for a business model your size.

These are the other types of costs and will change as you sell more or fewer products and services. Some examples of these are supplies like shampoo, hair color, and other processing chemicals, as well as disposable items like rubber gloves and sanitizer.

Of course, more customers wanting a full head application of color is a good thing, but the sales of these services will affect how much product you need to purchase.

You can easily stay on top of and track your professional and retail inventory using salon software and even set up automatic reordering for fast-moving supplies and products.

Most of the time, a salon’s owners will count staff salaries as recurring costs in their financial plan, but if you add extra hours or help during busy seasons, you may want to start to track this as a variable amount.

The next step of the financial plan process is adding together your total revenue and then subtracting your costs. This lets you model how much you’re making each month and any areas where your business is losing cash flow.

Try inputting it into a financial spreadsheet that you can change, update and extrapolate information from as things progress.

Do not miss our post on Salon Pricing Guide.

Having a solid idea of your cash flow is important for every business model and helps ensure a strong financial head start.

Of course, these figures can take time to adjust in the long term, but if you’re trying to achieve a solid financial plan, then your first step will be putting all the money going in and out of your business onto a salon budget spreadsheet.

Take a look at your total income versus what you pay out each month (this includes regular payments such as taxes, a mortgage or loan debt, as well as one-off amounts or infrequent payments, which you can then divide out over a period of months).

If your final amount coming in is more than what you’re paying out, this means that your business has a positive cash flow. You can create a salon profit and loss statement to track these amounts and communicate this to any potential investors.

Now, you can take another look at your costs and profits and see what financial planning you can do to improve your overall cash flow.

Now that you understand your business model and its costs, you can create a solid financial plan to help you cover them.

Understand how much cash you need to make to cover your costs and make a profit, then figure out how your staff can help you achieve this by setting goals.

Set realistic targets for your team. Feel free to get creative and track different metrics that have an effect on your business such as new client bookings, recurring customers, retail profits, and upselling, for example. Learn more about from our post on Salon KPIs.

You can also offer incentives and rewards for exceeding goals, such as free services, bonuses or commissions.

Figure out what works best and what doesn’t, where you can cut expenses, and apply any changes.

You’ll want to review your progress monthly and quarterly, making sure to forecast what will happen and update your financial plan. You’ll want to know whether you’re going to meet your targets in time to change course or take action if necessary.

You always want to have plenty of time to plan if you need to cut costs or increase revenue.

Having a solid salon marketing plan is just as important as making your financial plan.

While it’s important when attracting customers, marketing can also be very expensive. Feel free to shop around before choosing a marketing campaign. Listen to a variety of pitches and get second opinions from friends, family and colleagues.

Make sure your campaigns are efficient and will actually generate profits for your salon.

Smart salon software can help you with your financial planning in a variety of ways.

It makes it easy for you to find the information you need about overall performance and specific financial details when creating reports:

Revenue from services and products, gift certificates sold;

Costs of sales e.g. stock, back bar, hair stylists commissions, overhead, etc.

Salon appointments made, and average appointment ticket;

Cash collected;

Revenue and costs forecasts.

It can free you up to focus on other aspects of your salon business plan by providing insights into sales and customer information in an easy-to-read format.

You can even use this software’s dashboard features to generate visual reports, complete with graphics to show your results and overperformance at a glance.

Your business plan should also take bigger amounts into consideration, such as one-off emergencies (these happen to even the best financial planners), new equipment purchases or the price of rent for these, or last-minute hiring or advertising needs.

Include a budget for this in the financial section of your salon business plan, and keep this amount set aside, just in case.

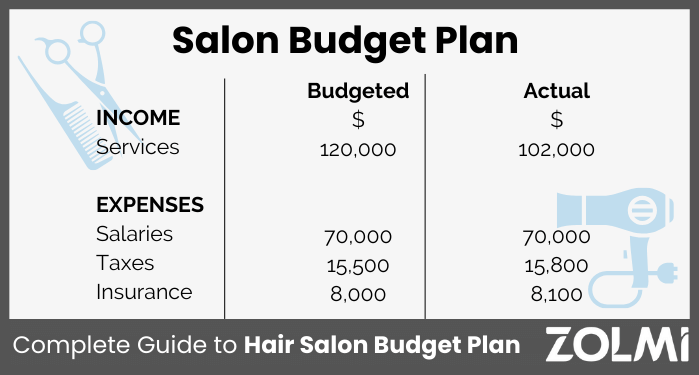

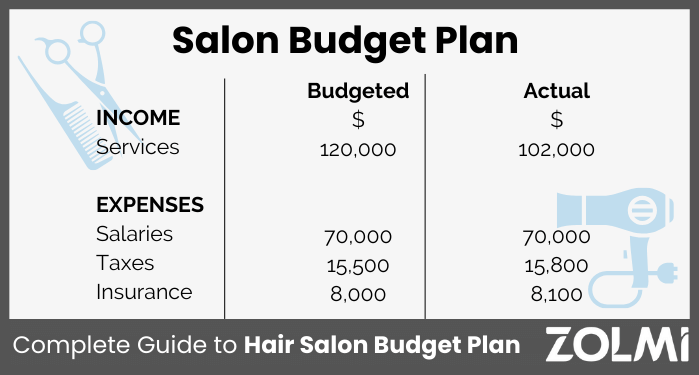

So how much does it cost to run a salon monthly? Well, that depends on the salon. But, we’ve put together some salon budget examples in this template to help you get started.

Financial planning is not usually easy, but having the right plan in place for your salon can save you a lot of time and stress down the road.

It’s often easier to prepare extra details beforehand than to research them later when you need them, and this holds true for financial planning, too.

Having your hair salon budget plan ready to go will help ensure that your business gets off to a strong start and stays that way.

The successful business plan: secrets & strategies

https://books.google.com/books?hl=ru&lr=&id=hp

Budget

https://www.practicetrack.co.uk/media/171051/sample_hits19.pdf

Budget planning, budget control, business age, and financial performance in small businesses

https://search.proquest.com/openview/188e999501f9da3edca46fd125dac3