Hair Stylist Insurance Guide for 2024

Hair stylist insurance is one of the first things you sure consider before starting your business. It helps to protect you in all sorts of situations, providing necessary coverage when case accidents happen and you face professional and general liability.

We’ll look at the different types of insurance, including hairdresser liability insurance, to protect your business, the coverage you need and the costs.

So why do you need coverage like cosmetology liability insurance, compensation coverage, and general liability insurance as a hair stylist?

You may not want to think about it, but all kinds of things can go wrong. An injury could happen when certain styling tools are being used, a client might slip and fall on the floor, property damage might happen because of accidents or angry clients, and so on.

Fortunately, whether you’re dealing with client injuries, equipment and property damage, or some other kind of risk, accident, medical bills, legal expenses, third-party claims, insurance can cover you.

Liability insurance protects you in scenarios where you could be facing legal actions like lawsuits or financial ruin.

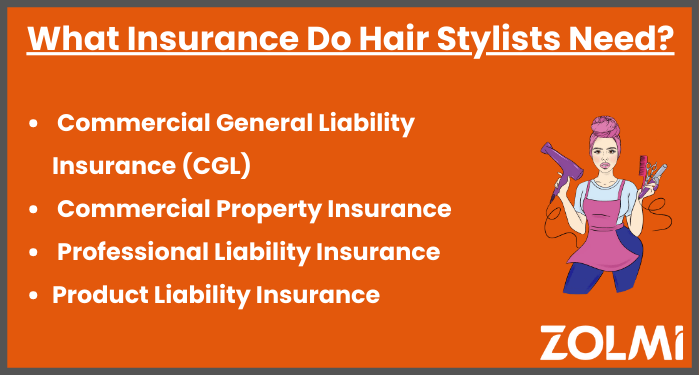

There are many different kinds of hair stylist insurance. If you look online, you can find references to all sorts of coverages, like professional liability insurance, general liability coverage, business owners’ policies, personal injury insurance, hair stylist safe insurance, hair stylist services insurance, hand insurance for hairdressers, and much more.

So which ones do you actually need to protect your business operations and keep your customers and team members protected? Here is a brief rundown of the main policy varieties:

General liability policy protects hair stylists from lawsuits and claims if one of your clients gets hurt or you are held responsible for damaging property that doesn’t belong to you. For example, if somebody slips on a wet floor or liquid gets spilled on their computer. It will co ver the medical expenses fo instance.

When it comes to insurance, commercial property insurance is designed to cover the property that hair stylists own and use each day. Commercial insurance can include the building itself, along with related tools and equipment you use to provide services.

Professional liability insurance will protect hair stylists if make a mistake causing your customer to lose money. professional error that leads to losses or damages for a client or customer. If you’re insured in this way, you won’t have to worry about covering the cost of a claim that a client makes if they get hurt while having their hair coloring.

Product liability insurance protects claims for damages cause by hair products used or sold (such as chemical burns) or property damage (such as stains on fabric). Product liability insurance typically covers damage that is usually the result of design, manufacturing or marketing defects, such as mislabeling or lack of safety warnings.

Do not miss our post on salon expenses.

If you are renting a chair from a booth renter, you may also need insurance. You don't have to worry about things like workers' compensation, but you do need to have booth rental insurance. This type of insurance is designed to protect both the renter and the independently licensed hairdresser.

It is very similar to the other types of insurance listed above and provides coverage for property damage, general liability, professional liability and more. You can often find renters' packages that include all these different types of policies, or you can purchase them separately.

It is a good idea to call and speak to an agent to get free expert advice on your options.

We recommend you to check out our post on bookkeeping for hair stylists.

We’ve seen some of the benefits of different insurance types and looked at some of the top ways to insure your business, but how do you find the right policy and the right insurance company? Well, there are a lot of different companies out there, and it's important to take your time, read reviews, check policy fine print, and choose the right insurance company to insure your hair stylist. Here are five licensed companies you can rely on to deliver the business insurance coverage you need:

The Hartford - The Hartford is an experienced and highly-rated insurance company. It offers a wide range of policies, including customizable business owners insurance. It also has an impressive A+ rating and offers coverage across the contiguous US.

Beauty & Bodywork - Beauty & Bodywork is another top-rated insurance company to consider. It offers fully-featured coverage plans at really affordable prices. You can pay less than $100 a year with this insurance company to get huge amounts of professional liability and property damage insurance coverage. Students get discounts, too.

CyberPolicy - You may have seen this insurance company appearing in an insurance commercial online. It's actually a comparison site that you can use to compare prices and policies with different trusted carriers. All you have to do is fill out a simple application form and then pick the insurance company that works best for you.

Allstate - Allstate is a well-known and widely-trusted insurance company. It offers general liability insurance and commercial property insurance as part of business owners plans. There are other potential add-ons you can choose with this insurance company too, like lost wages coverage or crime insurance, which is ideal for hair stylist owners and employers who worry about issues like theft in the workplace.

Hiscox - If you're running a home hair stylist, Hiscox is a great business insurance company to choose. They offer business owners plans and simple online applications, so you can find quotes and get prices in a matter of seconds.

To learn more about hair stylist salon duties check out our post.

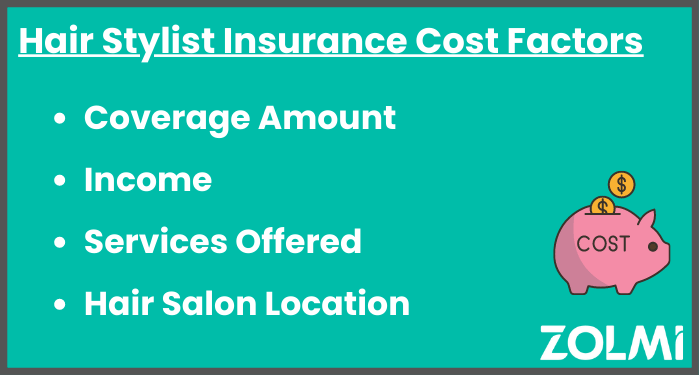

Hairdresser insurance costs vary depending on basic and additional coverages you choose.

Coverage Amount - The higher coverage, the higher monthly or annual premium will get.

Revenue - Businesses that generate lots of revenue usually have to pay bigger premiums, due to the fact that they have more to lose.

Services - The types of services you offer can also impact the prices you need to pay, as some services are deemed to be riskier and more likely to lead to claims.

Location - Location may also affect the cost to hair stylists.

The base hair stylist insurance policy starts from just a couple of dollars a month. Average prices can range from anywhere as low as $50 per month all the way up to $250 per month. Home hair stylist insurance should be lower than this.

Do not miss our post on how to hire hair stylist.

Hair stylist insurance protects you against all sorts of unforeseen accidents and difficult situations, and it’s a legal obligation for small business owners to have certain kinds of coverage in the hair industry.

Hopefully, this guide has helped you understand more about your insurance needs as a hair stylist, as well as answering some questions you may have had about the costs of hairdressing insurance and how to find the right policies.

Insurance and risk

http://lchc.ucsd.edu/cogn_150/Readings/ewald/ewald.pdf

Insurance, information, and individual action

https://www.sciencedirect.com/science/article/pii/B9780122148507500279

Risky business: Insurance companies in global warming politics

https://direct.mit.edu/glep/article-abstract/1/4/18/14134